do you have to pay taxes on inheritance in tennessee

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Tennessee levies tax on other items outside of income.

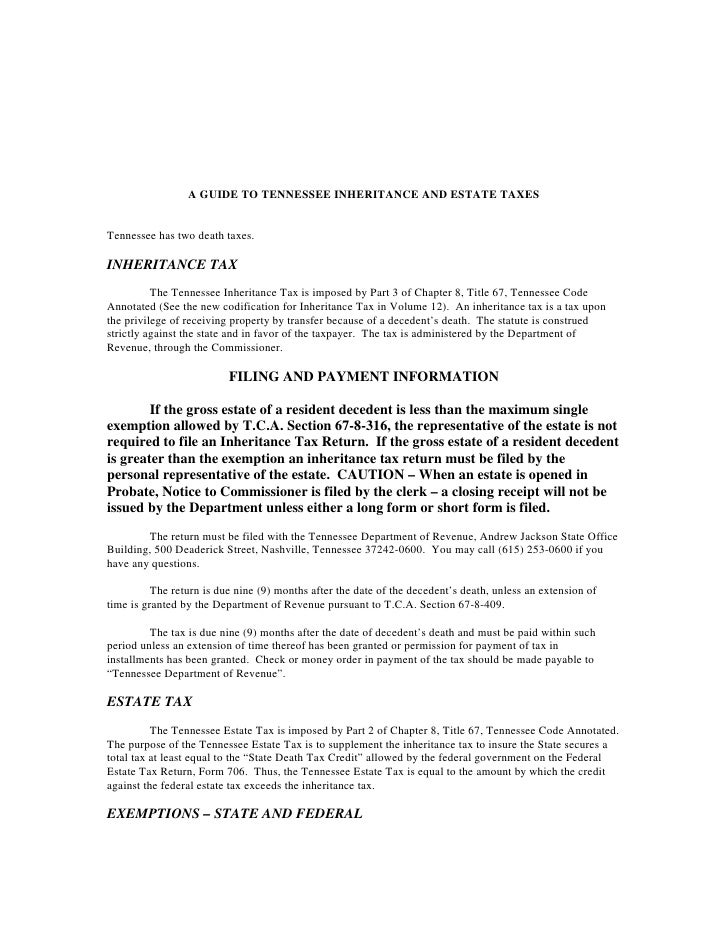

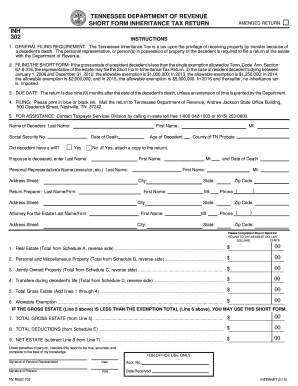

Fill In State Inheritance Tax Return Short Form

Inheritances that fall below these exemption amounts arent subject to the tax.

. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Who has to pay. This might not help you avoid inheritance taxes but it will lessen your estate taxes.

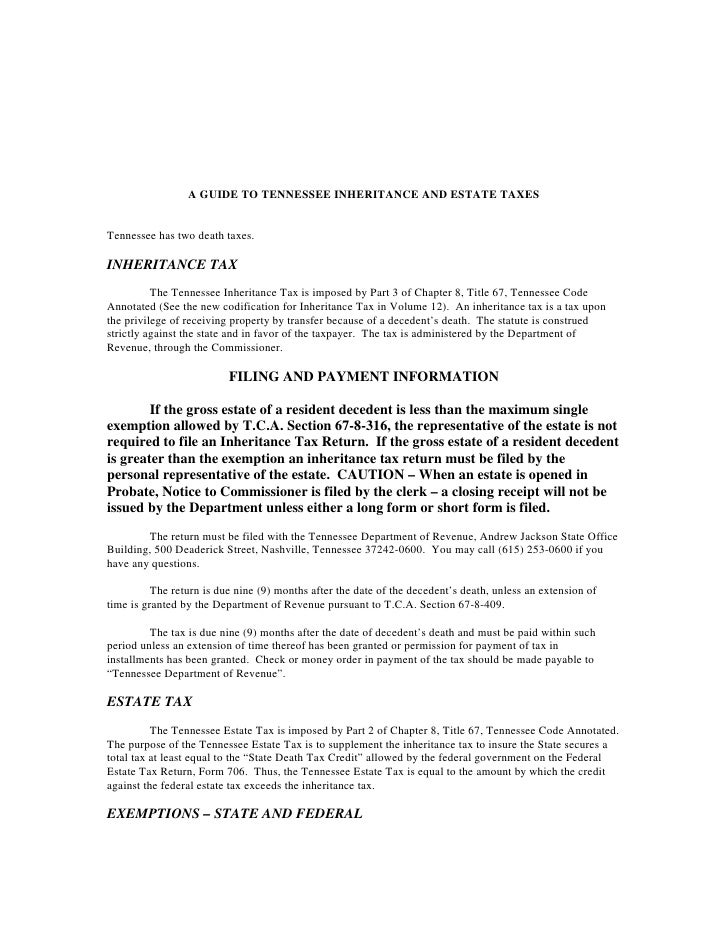

Gift and Generation-Skipping Transfer Tax Return. An inheritance tax is a tax on the property you receive from the decedent. We hope the following information provides some basic information about Tennessees inheritance.

You can give as much as 16000 to one person. More importantly people are looking to understand when taxes apply and when people do not have to pay them. As of 2021 the six states that charge an inheritance tax are.

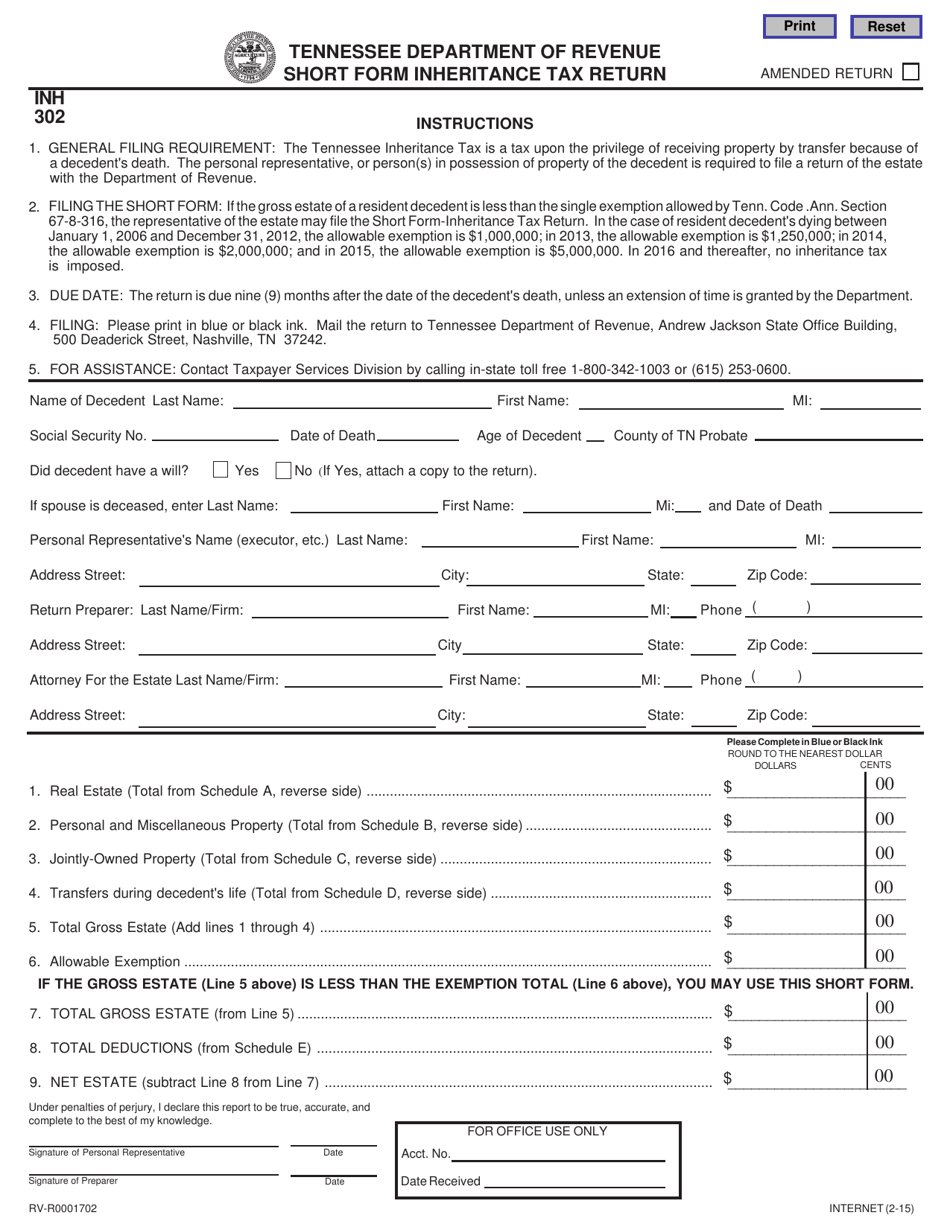

This is a term that describes any tax one may encounter when receiving an inheritance. However taxes can be a complicated subject. How Do Inheritance Taxes Work.

The death tax is just a popular. This gift-tax limit does not refer to the total amount you can give within a year. The possibility of the government taxing your hard-earned money after your death is a valid concern.

Inheritance tax rates differ by the state. Inheritance Tax by State. 2 An estate tax is a tax on the value of the decedents property.

So do you pay taxes on inheritance. Also in this case you need to file Form 709. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

Michae Davies Spanish lawyer with over 25 years handling estate planning and probate for ex-pats all over Spain explains when inheritance tax needs to be p. The eight states that levy an inheritance tax comprise Indiana Iowa Kentucky Maryland Nebraska New Jersey Pennsylvania and Tennessee. This is how they collect money to pay for municipal items such as first responder services infrastructure roads schools and more.

There is no federal inheritance tax. Of course state laws are subject to change so if you are receiving an inheritance check with your states tax bureau. All inheritance are exempt in the State of Tennessee.

Tennessee Inheritance and Gift Tax. The inheritance tax applies to money and assets after distribution to a persons heirs. Inheritance tax is often on every dollar inherited and only the surviving spouse and minor children are exempt.

How much money can you inherit before you have to pay taxes on it UK. You will get a boost in basis for all assets up to the date you die. The inheritance tax is a tax charged to the recipient of the estate.

The Federal estate tax only affects02 of Estates. The Federal estate tax only affects02 of Estates. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Point your camera at the QR code to download TikTok. At the federal level there is no tax on.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Each state is different and taxes can change at the drop of a hat so its a good idea to check tax laws in your state or better yet talk to a tax pro. The inheritance tax is paid.

The inheritance tax is different from the estate tax. PA NJ MD KY IA and NE. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

Example Your estate is worth 500000 and your tax-free threshold is 325000. Be aware of that your assets located in other states may be subject to that localitys inheritance or estate tax. As you plan for your financial future and its a good.

Even though Tennessee does not have an inheritance tax other states do. The federal government does not have an inheritance tax. Up to 25 cash back Update.

Therefore the Tennessee income tax rate is 0. There are NO Tennessee Inheritance Tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

Now for some good news. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. It is one of 38 states with no estate tax.

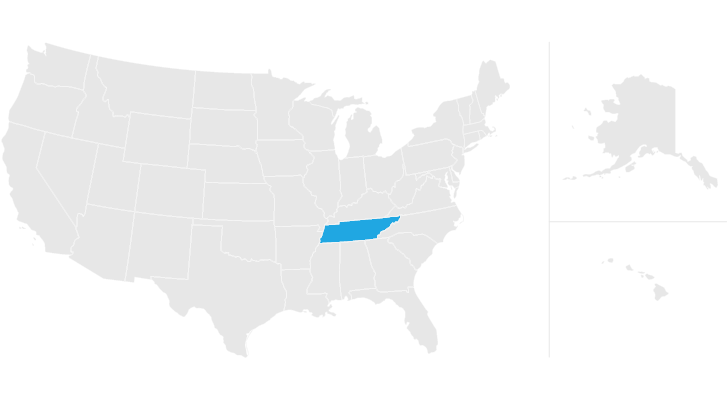

The state doesnt have any of its own inheritance or estate taxes though your property and assets may still be subject to the federal estate tax. All inheritance are exempt in the State of Tennessee. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year. The following is a description of how the tax worked for deaths that occurred prior to 2016.

These states have an inheritance tax. The inheritance and estate taxes wont be a concern of Tennessee residents who dont own or inherit the. Thats because federal law.

Uncle Sam doesnt have an inheritance tax and inheritances are not considered taxable income in most casesso you wont have to report your inheritance on your state or federal income tax return. Other than the Inheritance and Estate taxes there are other taxes that you might have to pay. For deaths occurring in 2016 or later you do not need to worry about Tennessee inheritance tax at all.

Tennessee does not have an inheritance tax either. Its only charged on the part of your estate thats above the threshold. Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax.

Its paid by the estate and not the heirs although it could reduce the value of their inheritance. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. Do you have to pay taxes on inheritance 0 views Discover short videos related to do you have to pay taxes on inheritance on TikTok.

Tax rates and laws vary depending on the state and rates are. It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends. There is a chance though that another states inheritance tax will apply if you inherit something from someone.

The capital gains tax is the tax you pay for acquiring an asset. If you receive property in an inheritance you wont owe any federal tax. This tax is only charged by 6 states.

Depending on whether or not youve prepared a valid will at the time of your death Tennessee inheritance laws surrounding your estate will vary wildly. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. You would pay an inheritance tax of 11 on 25000 50000 - 25000 when it passes to you.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. The standard Inheritance Tax rate is 40. The first rule is simple.

There are NO Tennessee Inheritance Tax. Tennessee does not have an estate tax. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live.

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

Tennessee Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

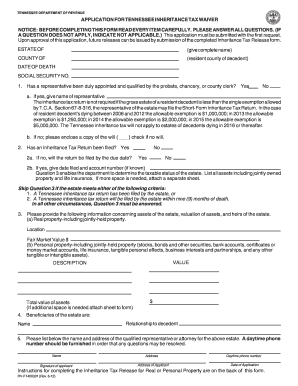

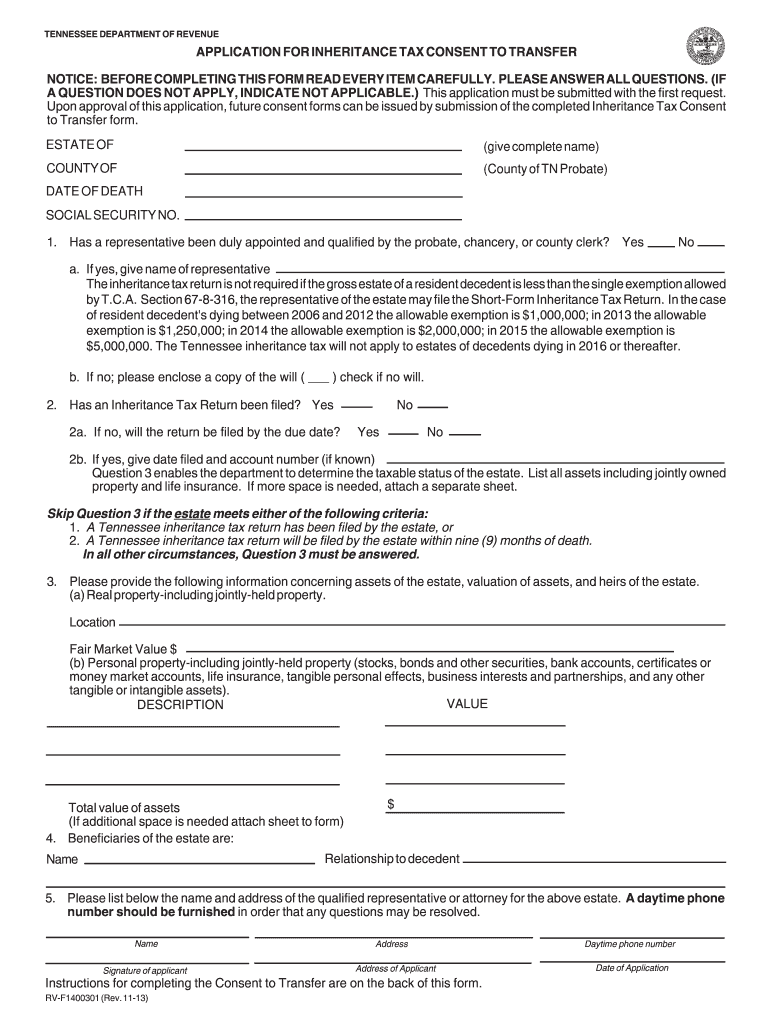

State Of Tn Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

How To Inherit Retirement Assets In Tennessee

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Inheritance Laws What You Should Know Smartasset

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

Tennessee Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Is Your Inheritance Considered Taxable Income H R Block

Here S Which States Collect Zero Estate Or Inheritance Taxes

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die